Should smart water tech be zero-rated for VAT?

At Watergate, we believe that saving water shouldn’t cost the earth. As pressure grows on UK water supplies and bills continue to rise, households and businesses are looking for smart, preventative tools that reduce waste, improve efficiency, and protect properties from damage. But there’s one thing holding many back: price.

Right now, smart water management solutions like Watergate’s Sonic – which detects and shuts off leaks automatically – are usually subject to 20% VAT. That means our household customers pay more upfront for technology that ultimately reduces environmental harm, saves money long term, and eases pressure on national infrastructure.

It begs the question: shouldn’t water-saving products be incentivised – not penalised – through the tax system?

The case for lower VAT on water efficiency tech

The UK government already applies lower VAT rates to certain goods and services that deliver social or environmental benefits. For example:

-

5% VAT applies to energy-saving materials in homes.

-

Zero VAT can apply to certain new builds, renovations for disabled access, and other specific construction activities.

This also means that many items like air source heat pumps and solar panels are currently zero-rated for VAT in the UK – meaning no VAT is charged.

Water is just as vital as energy – arguably more so in the context of climate change. The Environment Agency has warned that parts of England could run out of water within 20 years. Meanwhile, we lose over 3 billion litres of water every day to leakage alone. Tackling this challenge requires a combination of infrastructure investment and behaviour change – but also smart technology that empowers people to act.

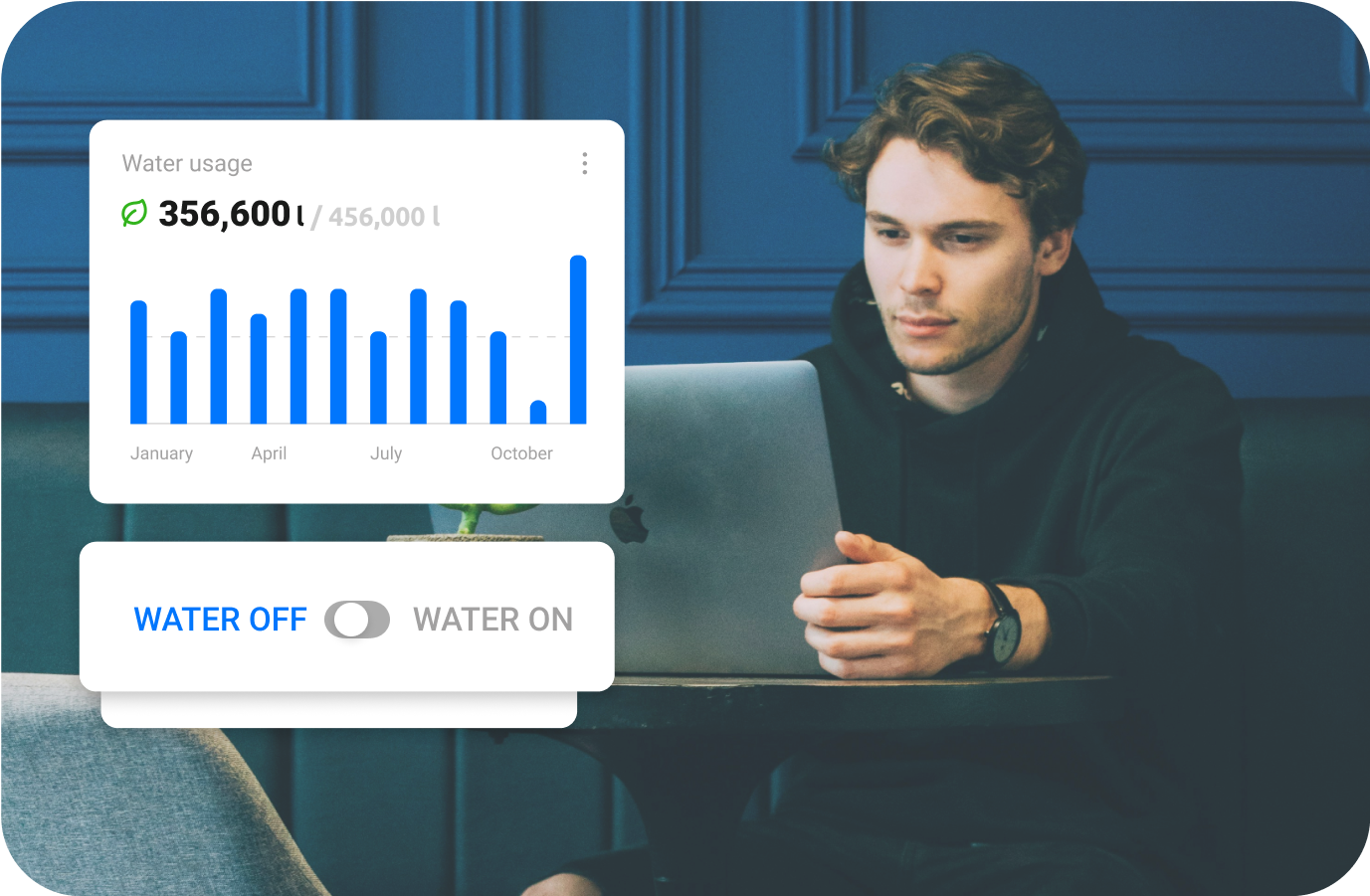

That’s where Watergate comes in. Our household customers have reduced their water consumption by 26.8% on average, and our business customers by more than 60%. The carbon and cost savings are significant.

But these benefits would multiply with even more widespread adoption – and a lower VAT rate could help make that happen.

What about existing incentives?

Some UK water companies already offer infrastructure charge discounts for new developments that meet high water efficiency standards. For example, Thames Water provides up to £400 per property off connection fees if a development is designed to use just 110 litres per person per day or includes features like rainwater harvesting or greywater recycling.

New residential dwellings (i.e. new homes built from the ground up) can also typically qualify for zero-rated VAT (0%) on construction costs, materials, and many related services. This applies when the entire building is new, and it meets the criteria set by HMRC (e.g. separate access, not connected to existing structures, proper planning consent, etc.).

This means developers or self-builders don’t pay VAT on most construction services and goods – a major saving compared to refurbishments or retrofits. Conversions of non-residential buildings into homes (e.g. barns into houses, office-to-residential) can also qualify for zero-rating on eligible construction services.

These are welcome steps – but they only apply to new builds and are aimed at developers, not everyday households.

That means the tax system rewards new construction, but does little to incentivise millions of homeowners and landlords to retrofit their properties with technology that prevents water damage and cuts waste.

If we want widespread adoption of smart water-saving technology like leak detection, shut-off valves and consumption monitoring, we need incentives that work for existing homes, homeowners, and landlords too. A lower rate of VAT could do just that – making water efficiency affordable and accessible for millions more properties across the UK.

What other countries are doing

Other governments are already recognising the value of water-saving technology in their tax policies.

-

Poland, for instance, applies a reduced VAT rate (8%) to water-saving devices as part of broader efforts to improve environmental performance and resource efficiency in buildings.

-

In Germany, municipal subsidies and rebates support installation of water conservation technologies in homes and commercial buildings.

-

Some US states offer tax credits or sales tax exemptions for products that meet water efficiency standards.

The logic is simple: when you reduce the cost of doing the right thing, more people do it.

Time for a UK review?

If the UK is serious about tackling water scarcity, protecting homes from water damage, and meeting its Net Zero ambitions, then it’s time to look at how our tax system supports (or hinders) progress.

We would love to see a review of VAT on water efficiency products – including leak detection, automated shut-off systems, and water monitoring platforms – to bring them in line with energy-saving measures.

At the very least, there’s a strong case for reducing VAT on these products in residential settings and rental properties, where landlords have a duty to prevent damage and ensure efficiency.

Let’s make saving water more affordable

Lowering VAT on smart water technology wouldn’t just benefit early adopters. It would:

-

Incentivise sustainable behaviour

-

Cut insurance and infrastructure costs

-

Reduce the burden on the water system

-

Improve building resilience

-

Support the UK’s net zero and water neutrality goals

Water is too precious to waste – and too important to tax like a luxury. Let’s treat it that way.